RIA vs. Broker

Comparing Registered Investment Advisors and Brokers

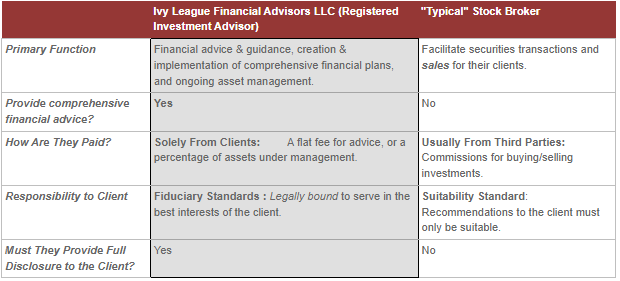

In financial services, there are basically two types of financial advisors: Registered Investment Advisors (RIAs) and brokers. Most investors do not understand the difference between them, and that can lead to investors making incorrect assumptions about how they will be treated by their chosen advisor.

Investor confusion is compounded by the efforts of many national brokerage firms to adopt the language and appeal of RIAs, even though they do not adopt the same high principles and standards. Brokers want to look like RIAs, especially Fee-Only RIAs such as Ivy League Financial Advisors.

But the differences between RIAs and brokers are stark.

The differences not only include how different advisors are paid, what information they disclose, and whether or not their allegiance is to their client. The basic underlying function of their service is different: RIAs are true advisors, but other financial professionals are primarily salespersons.

Consider your choice. You can work with an RIA who will consult with you to develop a comprehensive financial plan, and then help you to implement it over time. Or you can work with an investment brokers, insurance brokers, or commissioned financial advisor who is primarily engaged in facilitating your purchase of a financial product.

How To Choose a Financial Advisor: A Comparison Chart

Registered Investment Advisor (RIA)

RIAs, such as Ivy League Financial Advisors, are regulated by the Securities and Exchange Commission (SEC). Smaller RIAs are regulated by state securities administrations.

In either case, federal and state law requires that RIAs are held to a Fiduciary Standard when working with their clients. This law requires that an advisor act solely in the best interest of a client, even if that interest is in conflict with the advisor’s financial interest. RIAs must disclose any conflict or potential conflict to the client prior to and throughout a business engagement. Investment advisors must adopt a Code of Ethics and fully disclose how they are compensated.

Broker

Brokers are individuals or firms that charge a commission for executing buy and sell orders as submitted by investors. Brokers are overseen by the SEC and (usually) by the Financial Industry Regulatory Authority (FINRA), a self-regulatory organization that enforces violations of broker standards in the U.S.

Brokers are not held to a Fiduciary Standard. Instead, they are held to a Fair Dealing Standard of commerce and are subject to a Suitability Standard of care for their clients. This means that their investment recommendations must only be “suitable” for a client, not necessarily in the client’s best interest.

Some brokers suggest that they are more consumer-focused because they are “independent,” rather than working directly for one of the national brokerage firms. However, there is no genuine distinction. Either way, the broker’s obligation is first to the firm and second to the client. At the large, well-known brokerages, other business interests of the firm might create additional conflicts of interest, such as when a firm trades as a principal with its customers.

The Difference

One way to understand the difference between an RIA and a broker is to think about visiting your doctor. You pay your doctor for an unbiased diagnosis based on your financial condition. How would you feel if your doctor was working on commission? Would you feel as confident about his or her recommendations if you knew that a pharmaceutical company was paying a commission on the drugs that were prescribed?

Your broker is making an investment recommendation that directly affects his or her compensation. A Fee-Only RIA isn’t. That’s the difference. As nationally syndicated columnist Jane Bryant Quinn wrote, “Financial planners who take commissions have a built-in conflict of interest...even with disclosure, my choice would be a Fee-Only planner.”

Call Ivy League Financial Advisors today and start working with an investment professional who is always on your side.